How to Generate Accurate Bulk Fuel Invoices

Tax Compliance is Key

As recent headlines indicate1, invoice accuracy is a fuel industry problem. Across the industry, invoices with errors of $15 or greater occur roughly 25% of the time. It is not uncommon to see error rates as high as 55%.2 Fuel supplier invoices are often wrong, and sometimes very wrong. By generating inaccurate invoices, fuel suppliers and distributors place their business at risk. The impact goes well beyond the gain or loss that occurs when an incorrect invoice is paid. Auditors can discover unpaid tax liabilities years later and require payment of accumulated taxes along with penalties and interest.

In general, invoice inaccuracy is not born of malicious intent. But regardless of the reason, when a buyer discovers errors on their invoices, they will naturally lose trust in their supplier. A supplier that generates bad invoices risks damage to hard-won customer loyalty and market reputation.

The Indirect Fuel Tax Challenge

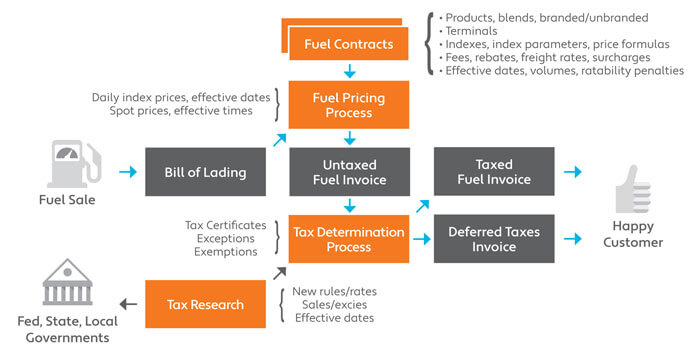

Getting accurate fuel volume, pricing, freight, sales tax, and excise tax together on a single invoice has always been a challenge. Indirect tax discrepancies are a major source of problems in particular. There are federal, state, county, and city taxes of multiple types, including sales, excise, and environmental taxes. Each product type, including gas, diesel, and various blends, has a unique tax treatment in each jurisdiction. Taxes will also vary based on the origin and destination locations, the transaction type, and whether buyers and sellers are licensed distributors. Any misunderstanding of these rules or rates will cause indirect tax errors, as will any error in capturing the correct fuel volume or price.

Tax Changes – The complexity of fuel tax is made worse by constant change. Lower fuel consumption levels are driving governments to look for creative solutions to replace declining fuel tax revenues. In 2011, there were 254 separate fuel excise tax changes in the U.S. By 2013, the number of changes had increased to 523, a 106% increase.

Delivery Diversions – Often errors occur when the actual fuel delivery doesn’t go according to plan. This will cause the invoice, based on the original plan, to be in error. The actual delivery may entail a volume change, product change, delivery time change, and/or a diversion to another site. Any of these may cause an invoice error. If a diverted load is delivered to another tax jurisdiction, such as across a county or state line, the tax treatment will be completely different from the original plan.

Price Volatility – Since 2004, day-to-day fuel price swings of 3 cents or more rose from 6% of the time to nearly 50%. Swings of 5 cents or more rose from 1.6% of the time to 25%.3 Fuel price volatility is the new normal. Suppliers are creating complex contracts using multiple price indexes to more accurately mirror their costs and protect themselves from price swings. Prices move more every day, and even during the day, creating additional opportunities for pricing errors.

Alternative Fuels – Governments are creating incentives and mandates to encourage greater usage of renewable fuels. In the case of the federal RFS 2 (Renewable Fuel Standard 2) regulations and RIN (Renewable Information Number) credits, suppliers are starting to provide invoice credits or rebates based on the value of the RINs they receive when they sell bio-fuels. This creates a new type of complexity when determining tax on fuel invoices.

The fuel invoicing process is extremely complex. Accurate invoice calculation requires many data inputs, from many sources, which often change daily or even multiple times a day. It also requires proactive monitoring of constantly changing tax regulations.

The Impact of Inaccurate Invoicing

Margins – Fuel suppliers know they need to manage to tight margins. So while it’s great to negotiate a profitable contract, ultimately the contract terms are less important than what is actually paid. Only accurate invoices will ensure that the contract is being met.

Operational Costs – When buyers find invoice issues, an inquiry and problem resolution process kicks off, resulting in incremental costs to both supplier and buyer. Typically, both sides need to manually recalculate the invoice, based on the contract terms, relevant price indexes, and tax rules and rates. Sometimes, both tax accounting and IT resources are needed to validate the indirect taxes. When an invoice is in error, a credit and re-bill must be processed, accrued taxes need to be adjusted, and tax returns that have been filed need to be amended. During this process, the buyer withholds payment, increasing the supplier’s accounts receivable and reducing cash flow.

Increased Tax Risk – Long after the invoice has been paid, a buyer or tax auditor can find a problem, so undetected errors present a significant financial risk for a fuel supplier. A systemic error that goes undetected for months may affect every invoice for one customer or may affect all invoices for every customer in a specific tax jurisdiction. In the case of buyer overpayment, legal claims for refunds and damages can have a serious financial impact, and publicity can negatively affect the supplier’s reputation and brand. If taxes are underpaid, the supplier is liable for penalties and interest. If the buyer is no longer available or is not able to pay, the supplier can also be liable for back taxes.

Lost Business – Buyers have options. When faced with margin impact, operational costs, and increased tax risk, they will think twice before renewing their fuel contract with any supplier that sends them inaccurate invoices. Ultimately, the loss of trust will motivate them to consider competitors even if prices are higher.

Three Strategies to Ensure Invoice Accuracy

Fortunately there are ways to improve the accuracy of invoicing. Fuel suppliers need to consider the following invoicing best practices:

1. Source Data Accuracy

Since most invoice generation is automated, most errors are not due to arithmetic issues. As illustrated previously, many different data elements—from the BOL (Bill of Lading), to the contract terms, to the index prices, to the tax rules and rates—affect the invoice. Bad source data is almost always the cause of inaccuracy.

Establish an owner for each data element. The owner is the person or organization held accountable for timely and accurate data updates to enable accurate invoicing. For example, one person may be responsible for researching and tracking fuel excise tax regulations across all jurisdictions. Another person may be responsible for sales tax rules and rates. Specific owners should be assigned for BOLs, contracts, price indexes, surcharge rates, and business partner tax certificates. Too often, data collection is handled as a one-time project, with no one assigned to ensure timely data updates after the invoice generation process is in place.

Establish goals and measure source data accuracy. Setting goals, measuring, and creating a feedback loop can create a process for continuous improvement. Too often, problems that are easy to address are simply fixed by Customer Service, but no feedback is provided to source data owners, so the problem will likely happen again. All invoice issues identified by customers or auditors need to be tracked, classified, and reported to source data owners. Each owner should have error reduction goals for which they are held accountable.

2. Change Management Process

Errors usually occur when changes are introduced into either the fuel delivery or the invoice generation process. For a fuel supplier, a significant change might be offering a new product, selling into a new tax jurisdiction, or entering into a new type of contract. The implementation of new tax rules and rates risks impact to all of a supplier’s customers in the jurisdiction. Effective management of change will reduce invoice inaccuracy. A change management process does not need to slow things down — it enables visibility, accountability, and risk management.

Include all stakeholders. There are several organizations that have a stake in accurate invoicing, including sales, IT, fuel operations, tax accounting, and accounts receivable. Also include the source data owners. A change management process should include documentation of the change implementation plan, and the opportunity for review and feedback by all stakeholders.

Handle simple and complex changes differently. Some changes happen frequently, are well understood, and have relatively low impact if errors occur. Other changes happen less frequently, but can have significant impact if not handled properly. The change management process should handle simple changes simply. For example, the process for a new customer contract is well understood and happens every day. The change process may entail sending email to stakeholders with the customer’s profile, contract details, and planned start date. The test plan is to review the first few customer invoices manually. There is no stakeholder preapproval required, but stakeholders can ask questions and hold the start date if needed. For more complex changes, such as the decision to do business in a new region, the change management process may require tax research, system modifications, or extensive testing prior to initial sales. In this case, change management stakeholders may need to meet and formally approve readiness.

Test prior to production. More significant changes need to undergo a rigorous testing process. The goal is to catch any invoice errors prior to being sent to a customer. In the case of expansion into a new region, important use cases need identification so that they are thoroughly tested. For example, who are the customers in this region? Do they have tax exemptions? What terminals will be used? What products will be sold? What tax jurisdictions apply? Each possible combination of factors requires testing to ensure that invoicing systems handle them without error.

3. Tax Automation

Automation reduces invoicing errors. While many suppliers have adopted some automation, error-prone manual or spreadsheet-based invoice calculation is still quite common.

Use a fuel tax update service. Tax determination software can provide automated rate and rule updates that will keep sales and excise tax systems up-to-date. This eliminates the need to monitor federal, state, county and municipal tax authorities for regulatory changes. It also improves accuracy through use of a trusted data source and elimination of error-prone manual entry of new rules or rates.

Use automation to test efficiently prior to production. Automation means consistency and scalability. Use the same inputs, and you’ll get the same outputs. With this in mind, use a test setup to validate new use cases and regression test old ones to make sure that critical tax scenarios work as they should. Some tax automation products provide specific functionality to make it easy to run test transactions without impacting production data.

Use commercial software or services instead of in-house or manual solutions. Building fuel tax software in-house was once a necessity. Today’s fuel excise tax software has matured and now provides considerable flexibility. Commercial software provides lower cost of ownership and improves invoice accuracy, since processes and software are tested across a broad range of customers and use cases. Look for high quality tax determination solutions that have been customer-tested to accurately handle complex rules for multiple jurisdictions and many different supplier and buyer scenarios.

Summary: Accurate Invoicing Builds Trust

Inaccurate fuel invoicing is an expensive problem. The complexity of fuel contracts, price volatility, and tax law changes make it harder than ever to generate accurate invoices. A fuel supplier who’s not being proactive about accurate invoicing likely has a problem. When customers do not catch problems, inaccurate invoices are paid, and risk increases. When customers do catch invoice errors, they lose trust and take their business to the competition.

Using the strategies outlined here, savvy fuel suppliers are working to ensure indirect tax compliance and build a trust relationship with their buyers through accurate invoicing. A trust relationship results in lower costs, higher customer retention, and a positive market reputation.

References

1 Fleet Owner, Fuel invoice errors could be draining fleet profits, 14 April, 2014. Web.

2 FuelQuest, Accurate Invoicing: Building Trust Between Fuel Supplier and Buyer, 28 June, 2013. Web.

3 FuelQuest, Fuel Market Analysis: The New Normal, 5 September, 20

Contact us at: 877-780-4848