AvaTax for India GST Calculation

AvaTax is a cloud-based tax compliance solution that automates the complexities of calculating Goods and Services Tax (GST) in India.

Automate India GST calculations with AvaTax

Goods and Services Tax (GST) calculation is the first place where you are likely to go wrong and take a big financial risk for your business. Moreover, staying updated with changing legislative regulations, new GST rules, or shifts in GST rates can be daunting, if you’re relying on basic accounting systems to do it for you or you are calculating manually. Relax. We’ve got your back. Let AvaTax automate GST calculation for your business transactions and lighten workloads for your finance team.

Reduce risks of inspection and audit

Avalara AvaTax GST is a robust and highly accurate automated tax calculation engine which not only reduces your business audit risk but saves your time and money too. Leave the taxing parts of the business to us and focus on your business.

AvaTax GST works for businesses of all sizes

Whether you’re part of a large enterprise or running your own side business, we have solutions for you. AvaTax is trusted by major players in all kinds of industries.

Keep up with GST rate and rule changes

AvaTax GST keeps track of changes in legislative regulations for you and integrates with GST Network (GSTN) to automate preparation and filing of GST returns.

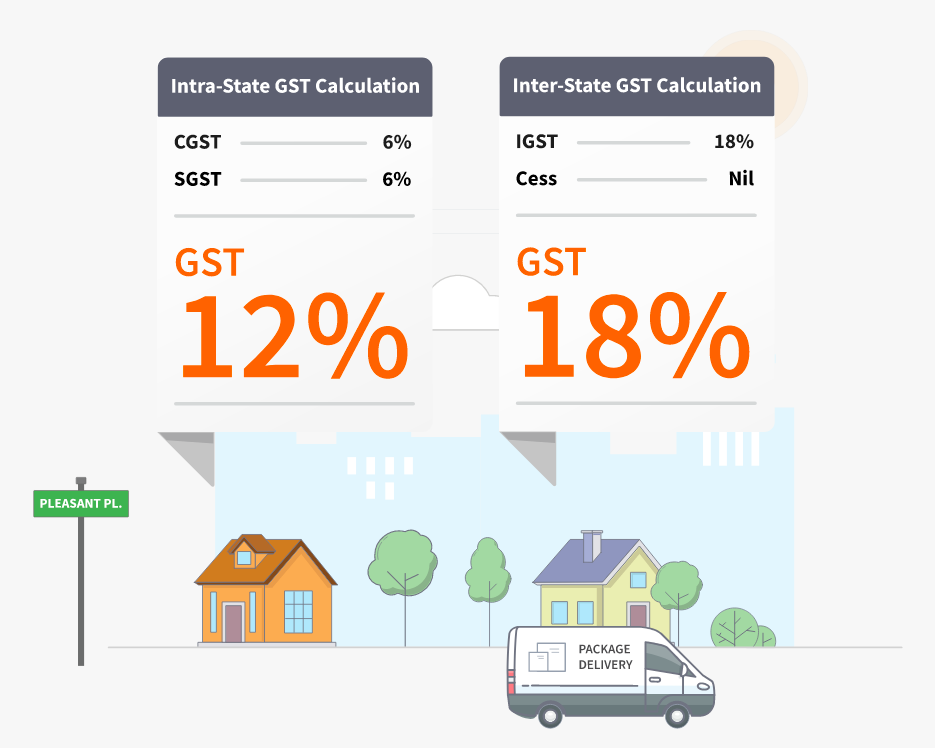

Automatically apply differing tax rates

GST rates for items differ based on materials, price point, function, or other factors that aren’t immediately obvious. AvaTax GST calculates the right rate for a variety of circumstances, including product-specific tax rates, destination rules, and more.

Manage international customs duties

Exporting into another country can incur a lot of additional costs: excise duty, shipping charges, and sales tax or VAT, depending on the jurisdiction. Avalara enables sellers of all sizes to determine the duties, taxes, cost of goods sold, and shipping costs for global commerce transactions in real-time.

Features and benefits

Integrate with ERP and other financial systems or export data from multiple business systems to determine GST on all financial transactions.

AvaTax GST consolidates your GST liabilities and significantly reduces the effort and time to prepare GST return needs.

Avalara is an experienced Application Service Provider (ASP) and partnered with multiple licensed GST Suvidha Providers (GSPs) as per GSTN guidelines in India.

Our platform is reliable, secure and scalable, calculating GST even during high sales periods for retailers and manufacturers.

With a robust API, AvaTax GST works with multiple systems across departments, so you get consistent, up-to-date information for all your teams.

From onboarding to integration, our tax experts and support teams guide you through the entire process of GST implementation.

Stay up to date on E-way Bill and GST news

Get regular updates, whitepapers and case studies on our resource center.